All of our people, Patty and you will Bryan, utilized the home’s security to transform its dated house on an effective area ideal for the huge nearest and dearest. It figured, why get someone else’s fantasy household when they you are going to renovate their very own? With some assistance from us, they utilized a home equity financing to create their property to help you its full prospective-and you may inspire-the outcomes talk on the by themselves.

*Annual percentage rate = Annual percentage rate from the 80% mortgage to help you worthy of. Prices active ount out of $5, is required. $5, into the this new money is required whenever refinancing a preexisting Members initially Household Guarantee Financing. Try conditions: For people who use $30,100 from the 4.99% Annual percentage rate for a beneficial 10-seasons name, your estimated payment per month could be $. For individuals who obtain $31,000 in the 5.74% Apr getting a beneficial 15-year identity, your estimated payment is generally $. Rates of interest are derived from creditworthiness plus house’s financing-to-value. Primary quarters simply. Possessions insurance policy is called for. Pennsylvania and you can Maryland homes only. Having non-users, you’re going to be needed to sign-up Professionals initial to fulfill qualifications standards.

**100% investment is available for the a beneficial priple words: For many who use $30,100 in the % Annual percentage rate getting an effective 20-seasons title, your projected payment per month could be $. Most other limits otherwise requirements will get pertain. Prices are at the mercy of transform without notice. Speak to your income tax mentor to possess income tax deduction information.

Pre-House Guarantee Mortgage

Which have has just ordered their brand new house, Patty and you may Bryan realized that it will need some try to it is getting “theirs.” Towards the fundamental living elements including the home, kitchen area and you will kitchen getting dated, the couple made a decision to rating a house security financing around to pay for particular big enhancements.

The major Reveal

Patty and Bryan made use of their property collateral financing provide the domestic a bit the conversion process! Improvements to their family room, home and dining area have made a critical influence on new features of its family for your nearest and dearest. They have the perfect get together place to create memories getting many years to come.

You need to you?

Since the Patty and you will Bryan’s tale reveals, credit from the equity in your home is a significant choice. But never worry-we are going to be along with you every step of your method.

Let’s Get cash advance payday loans Allenspark a hold of What is You are able to

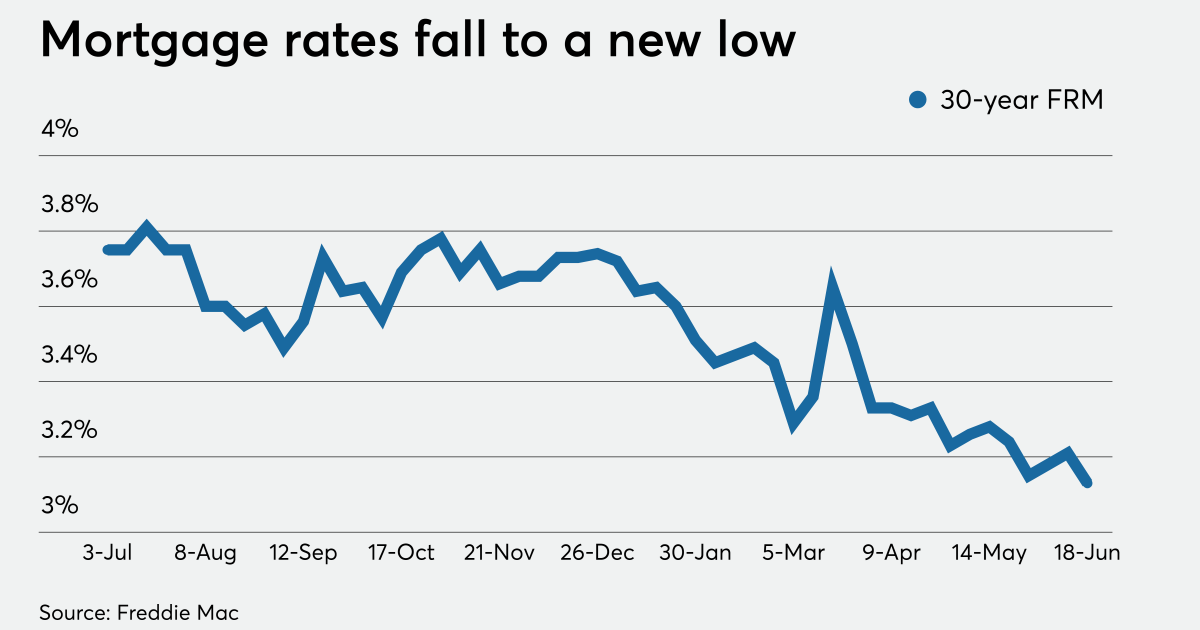

Household equity money can be used for some thing aside from renovations, also. Make use of house’s worth to cover university expenses, a unique vehicles, unforeseen expenses and much more. With loan costs still close historic lows, we could help you borrow up to a hundred% of your residence’s worth, which have terms and conditions up to 2 decades.** Done your application online, and you will a part are typically in touch to talk about your borrowing from the bank solutions and you can schedule an assessment to determine their exact being qualified terminology.

Home Dream House

Purchasing your dream home is those types of huge lives goals which you save having and you may desire. For Patty and Bryan, their dream home is that that have a bit more reputation than just that they had originally forecast. Manufactured in the brand new eighties, it saw their residence while the a good investment and you will desired to give they a small face-elevator so that they you are going to carry it to help you the complete possible. To take action, it knew they will you need some help economically, so that they considered united states for the majority direction. Follow this link to learn the full tale.

Discuss the probabilities

Having fun with domestic guarantee and work out home improvements go along with high income tax positives. Because the family security finance render straight down interest levels than just of numerous pupil funds and you can handmade cards, they truly are a simple way to cover a college education, loans a married relationship otherwise combine large-appeal loans.

User Worthy of Safety

Once you submit an application for your property Equity Repaired Rates loan, you can like to incorporate User Worthy of Cover (MVP). That it coverage often terminate the monthly premiums if there is passing, handicap, or unconscious jobless-versus penalty, added appeal, otherwise dings for the credit history.

Not sure? Why don’t we Cam.

Credit contrary to the security in your home is a huge decision. But never be concerned-we shall be along with you each step of means. Incorporate on the internet and we’ll contact talk about your options.