If you are care about-working and also you need it a house, you fill out an equivalent mortgage software because the everyone else. Home loan L lenders contemplate the same something while you are an excellent self-operating borrower: your credit score, how much personal debt you have, your possessions and your income.

So what is actually some other? When you work for someone else, loan providers go to your employer to verify extent and record of this money , and exactly how almost certainly its you’ll keep earning it. When you are care about-working, you are required to deliver the required documents to verify you to definitely your income was secure.

Qualifying Getting Home financing While you are Thinking-Employed

For individuals who work for your self, you are probably currently always needing to be more arranged and you will overseeing your earnings. That will help when it is time and energy to get home financing, and therefore will that it article on what to discover and how to set up.

Preciselywhat are Mortgage lenders Trying to find?

- Money balance

- The region and characteristics of your own worry about-work

- The brand new financial strength of business

- The ability of your company to create sufficient income throughout the future

Exactly what Records Want to Give?

To begin with your house purchasing process, you may need a history of uninterrupted care about-employment money, usually for at least 2 yrs. Listed below are some examples of data a lender you’ll inquire about.

Work Confirmation

- Latest website subscribers

- An authorized authoritative individual accountant (CPA)

- An expert business that can attest to their registration

- One state or business licenses you hold

- Evidence of insurance to suit your needs

Earnings Files

Provides evidence of constant, credible money, and you’re one step closer to bringing recognized for a home loan. Remember that even if you build uniform currency today, their past money might influence your capability to get a beneficial mortgage. The lender often request the next:

You could potentially however rating home financing on your own home, whether or not you have been thinking-used in below 2 years. Eventually, your business have to be effective having at least 12 straight days, plus current couple of years regarding a position (and additionally non-self employment) must be affirmed $1500 loan with poor credit in East Brewton.

In this case, their bank will most likely perform a call at-breadth look at the degree and you will training to decide if the providers normally remain a track record of balance.

Suggestions to Place your Most readily useful Software Pass

Since your individual company, you want your organization to look their best to prospects. As the somebody who would like to pick property, you would like your loan app and you may financial status to appear its better to loan providers.

Suggestion 1: Look at the Debt-To-Money Proportion

The debt-to-earnings ratio, or DTI, is the percentage of your gross monthly income you to goes to spending their monthly expenses. Lenders pay attention to they just like the you will be a reduced high-risk borrower if for example the DTI was lowest. That implies you really have a lot more budget for a home loan payment.

To calculate the DTI, separate your own month-to-month continual debt by the month-to-month income ahead of taxation. Changing monthly payments particularly utilities, property taxation, groceries and fixes commonly considered expense and you may are not taken into account when calculating DTI.

If your DTI is more than fifty% and you need to get home financing, work with lowering your loans before applying.

Idea 2: Keep an eye on The Borrowing

Lenders look at the credit score as a sign of the capacity to pay the money you owe. Your credit history, that’s filed on your own credit file, cannot bring your earnings under consideration. As opposed to their DTI, the better your credit score, more positive status you’ll end up set for home financing.

Several other basis for the credit history one to loan providers consider can be your borrowing usage. Which proportion actions how much cash of available credit you utilize.

Such as, when you yourself have a borrowing limit out of $ten,000 and also good $six,one hundred thousand harmony with it, the ratio is 0.60, or 60%. Just like your DTI, the lower their borrowing from the bank utilization ratio, the higher it is for your credit history, and therefore it’s better for your home loan software.

Suggestion 3: Remain Providers Costs Separate

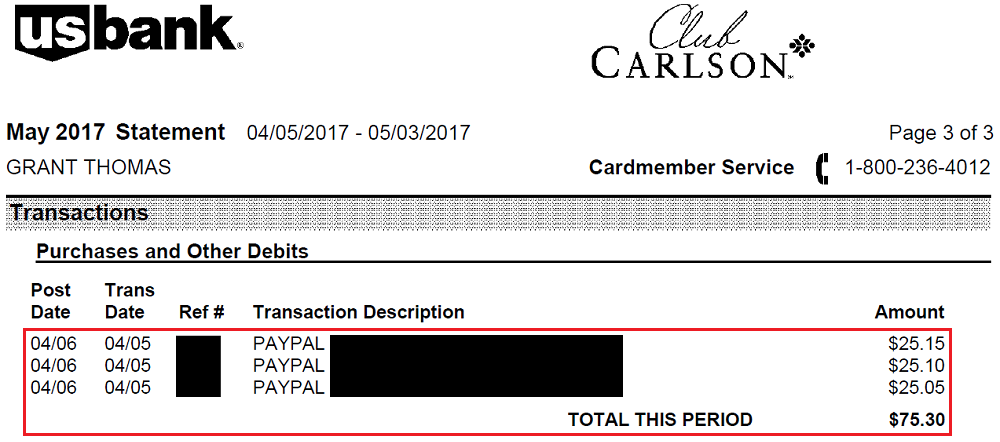

For individuals who costs team commands, like a new pc or office supplies, on the individual cards, you’ll be able to enhance your borrowing from the bank use. This could possess a poor effect on the application.

Keep company and private costs separate by giving them their own accounts and you may credit cards. This may passion a more good, sincere reputation on your own software.

The conclusion

To make an application for home financing if you’re notice-operating, you’ll want to make certain and you can file your earnings while maintaining a beneficial lower DTI and better credit history.

No matter what your own a job position, preapproval is a vital 1st step in the deciding what type of financial suits you. Rating preapproved with Skyrocket Home loan today!