Are you presently their studies at uni or TAFE, and also need it a property? Don’t be concerned, the two commonly mutually personal – you might possibly manage each other!

Australians like their tertiary knowledge, if or not that’s going to college or university or bringing professional courses. With regards to the 2021 Census, over 11 mil someone (11,511,655) around australia said which have a non-college or university (professional otherwise tertiary) certification, a beneficial 19.8% increase as history Census during the 2016.

As we like understanding, i and additionally love possessions, however, throughout investigation it can be hard to earn the income wanted to meet mortgage repayments. It’s possible regardless if, along with this article, we shall mention exactly how a student around australia is also safer a home financing – and if they will be.

Can pupils score a mortgage?

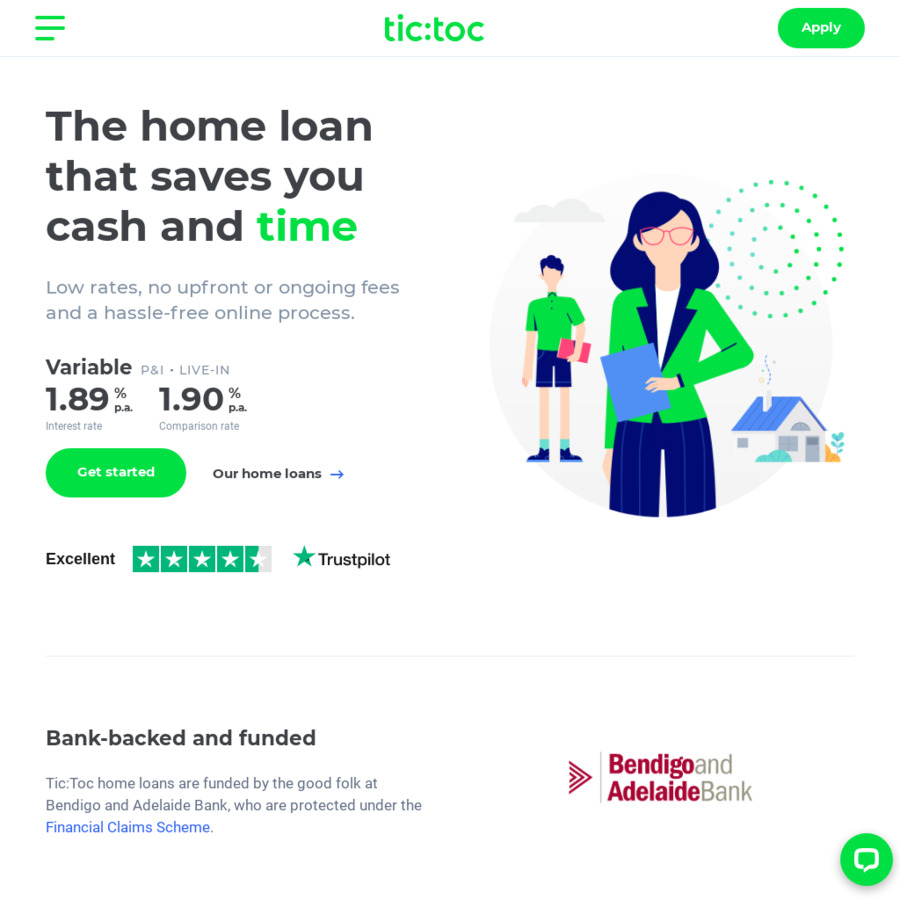

Considering Laura Osti, Chief Product sales Administrator within online bank Tiimely Household , it is seriously possible for students to get a house mortgage in australia.

Being a student does not perception the eligibility to have a mortgage, but you will need certainly to meet with the usual requirements as well as savings for a deposit and you can a living so you’re able to debt proportion that may solution the mortgage in fact it is difficult whenever you are studying, Ms Osti told .

Thus basically, yes, good college or university/TAFE scholar in australia can obtain a property as well as have a beneficial mortgage. They simply will discover it more complicated to acquire approved, but there is zero difficult code for financial institutions and you can loan providers that says they need to state no to students.

What about mortgage brokers for global children?

Sure, it’s possible getting in the world people to acquire property in australia while having a home loan. Essentially, you will be able for students to the following types of Visas to help you getting recognized for a loan:

- College student Charge (Subclass 500)

- Competent Recognised Scholar Visa (Subclass 476)

- Competent Graduate Charge (Subclass 485)

- Competent Regional (Provisional) Charge (Subclass 489

not, it can be very hard to getting acknowledged for a financial loan as students towards the a charge, because loan providers can get check globally people because riskier customers, since the and additionally uprooting the life to maneuver in order to a good this new nation, they still real time a beneficial student’s lifestyle and tend to be less likely to works more 20 circumstances each week. One of the better means to own all over the world children to boost its probability of acceptance, not, should be to has mothers overseas who’re willing to act as good guarantor to your loan in their mind, or keeps its moms and dads solution part of the financing in itself.

- Which have a top deposit (at least 20% together with 5% to pay for more will cost you such as stamp duty)

- Possess someone functioning complete-time

- Have a great credit history in australia

- Demonstrated a great offers habits while you are discovering

International college students may also you need approval on the Overseas Financial support Remark Board (FIRB) to order a residential or investment property in australia.

Suggests pupils may home financing

Even though it is a reasonable section more difficult to have a student discover approved to have a home loan versus individuals that have steady, full-time works, it is really not impossible. There are certain things you can do given that a beneficial pupil that will help go into the property markets, many of which as well as works generally for people towards the lower incomes.

How you can improve your chances is to find into the good deals development and control purchasing and you can personal debt. Very lenders would like to pick about three months’ property value way of life costs included in the application, making it best if you limit your expenditures https://paydayloancolorado.net/ponderosa-park/ on lead-up towards app, including closing (otherwise reducing the restriction towards the) your own handmade cards, Ms Osti told you.